Accountant job at I Care Hospital

Accountant

Company - I Care Hospital

Company - I Care Hospital

The scope of work for an accountant involves managing financial operations and ensuring compliance with relevant regulations. Here are some key responsibilities and tasks that accountants in small hospitals typically handle:

1. Knowledge of using Tally is a must.

2. Financial Record-Keeping: Accountants are responsible for maintaining accurate and up-to-date financial records for the hospital. This includes recording financial transactions, maintaining ledgers, and preparing financial statements.

3. Billing and Revenue Cycle Management: Accountants handle billing processes, including generating patient invoices, managing insurance claims, and processing payments. They ensure timely and accurate billing to optimize revenue collection.

4. Expense Management: Accountants monitor and control expenses for the hospital. They track costs related to supplies, equipment, utilities, and other operational expenses. They also analyze expenditure patterns to identify areas for cost savings.

5. Budgeting and Financial Planning: Accountants assist in the preparation of the hospital's annual budget. They collaborate with management to forecast revenue, estimate expenses, and allocate resources effectively. They monitor budgetary performance and provide financial insights to support decision-making.

6. Financial Reporting: Accountants prepare financial reports tailored to the hospital's needs. These reports include income statements, balance sheets, and cash flow statements. They ensure compliance with accounting standards and regulatory requirements.

7. Tax Compliance: Accountants handle tax compliance for the hospital. They prepare and file tax returns, calculate tax liabilities, and ensure adherence to applicable tax laws and regulations. They also provide guidance on tax planning and optimization strategies.

8. Payroll Processing: Accountants manage payroll processes for hospital staff, including salary calculations, tax deductions, and compliance with labor laws. They ensure timely and accurate payment of salaries and adherence to statutory requirements.

9. Financial Analysis: Accountants analyze financial data and provide insights to hospital management. They monitor key performance indicators, evaluate financial performance, and identify opportunities for improvement. They contribute to financial decision-making by providing data-driven recommendations.

10. Compliance and Regulatory Reporting: Accountants ensure compliance with regulatory requirements specific to the healthcare industry. They stay updated on relevant laws, such as those related to healthcare billing, patient data privacy (HIPAA), and labor regulations. They prepare and submit required reports to regulatory authorities.

11. Financial Systems and Software: Accountants may be responsible for managing financial software systems used in the hospital. They ensure proper implementation, use, and maintenance of accounting software to streamline financial processes and ensure accurate reporting.

It's important to note that in a small hospital, accountants may have additional responsibilities beyond their core accounting duties. They may be involved in administrative tasks, procurement, and financial coordination with vendors and suppliers. The scope of work may also depend on the size of the hospital, available resources, and the specific requirements of the organization.

Job Types: Full-time, Regular / Permanent

Salary: ₹9,000.00 - ₹15,000.00 per month

Schedule:

- Day shift

Supplemental pay types:

- Yearly bonus

Ability to commute/relocate:

- Vadodara, Gujarat: Reliably commute or planning to relocate before starting work (Required)

Education:

- Bachelor's (Required)

Experience:

- Tally 5 years experience (Required)

- Accounting 5 years experience (Required)

- total work (Preferred)

License/Certification:

- CA-Inter (Preferred)

Speak with the employer

+91____#####

Application Deadline: 20/06/2023

FAQs about this Accountant job

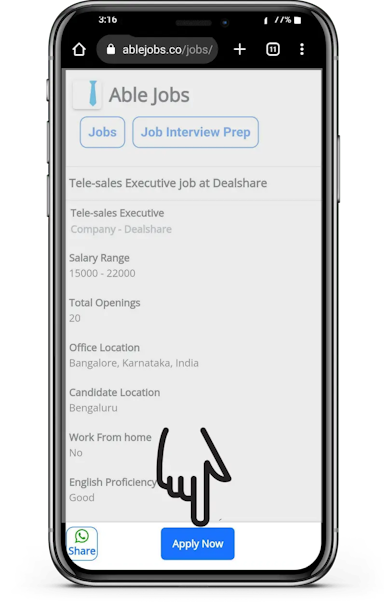

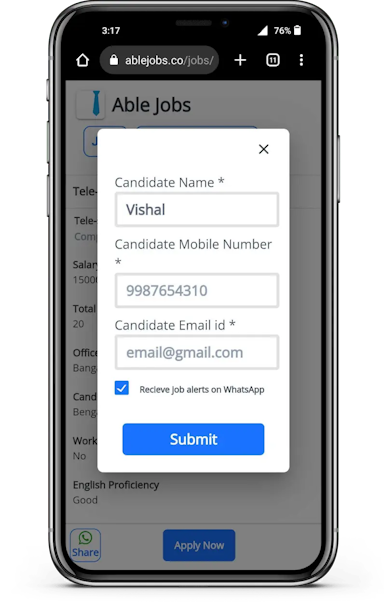

Go through the FAQs below to find answers to all your questions about this job.How to apply?

- 1. Click on Apply Now button at the bottom of the page

- 2. Fill in your details. (Please fill correct details as it will be shared to recuriter)

Is this a work from home job?

No, it’s not a work from home job and can’t be done online.

What are the skills required in this job?

- Business: Strategies

- Analytics: Optimization

Who can apply for this job?

- Graduates, Intermediate

Tip- Read the JD thoroughly to find all required qualifications

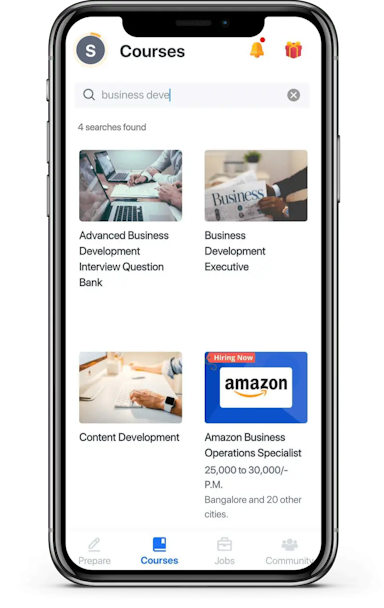

How to prepare for interview?

Once you have applied for this job, you can prepare for Accountant at I Care Hospital interview free of cost on Able app. In courses section of app search for Accountant, and enroll in the course and complete it before interview.